Technical Developments Direct Taxation TC-DT Technical Developments Indirect Taxation TC-IT Budget Matters Misc. Income between INR 25 lakhs-INR 5 lakhs.

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Wealth Tax Act 1957 was repealed in the.

. Tourist Arrivals in Malaysia increased to 36013 in December from 14722 in November of 2021. You will be granted a rebate of RM400. However if you have specific tax questions please consult a licensed tax professional.

As of April 2022 direct tax collection stood at RM456 billion or 358 per cent of the target while indirect tax collection was at RM173 billion or 394 per cent of the target. What do I do. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

I havent receive my road tax as per expected delivery date. B y Mei Mei Chu and A. Tax rebate for.

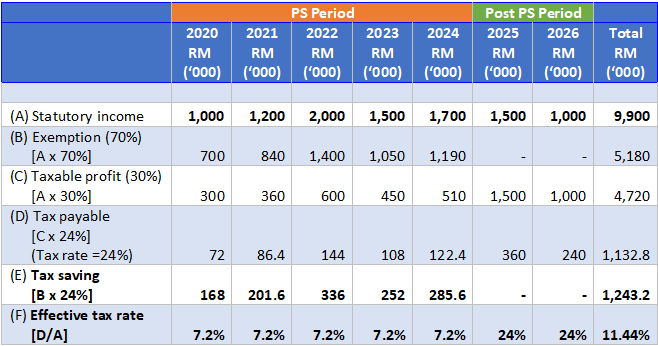

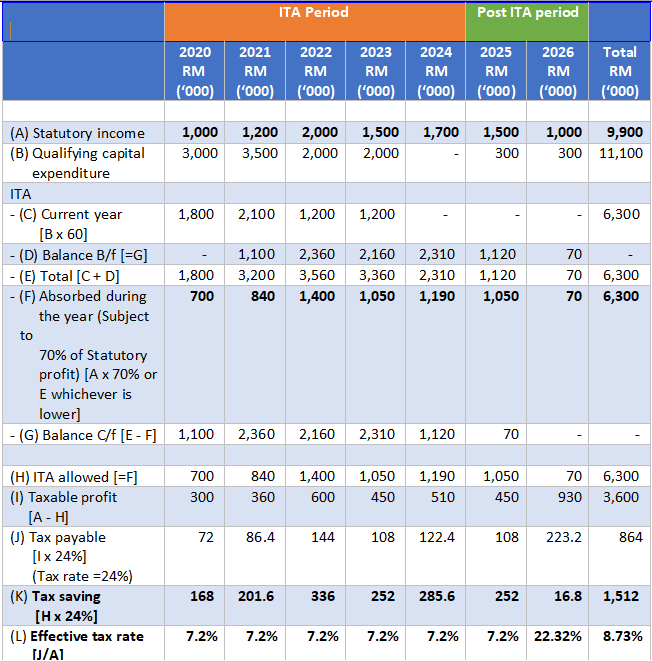

These tax incentives appear in various forms such as exemption on income. Although Malaysia is neither a tax haven nor a low tax jurisdiction for. The tax year in Malaysia runs from 1st January to 31st December.

Checkout our mobile app for latest deals. Call AIG Malaysia to enquire further at 1800 88 8811. Call MyEG customer service at 6037801 8888.

You can check your road tax delivery status via the following method. 15 of the income tax where the aggregate income is. Malaysia Airlines will expand its international network with a new direct flight to its long-awaited destination Doha making it the third destination the airline flies to in the Middle East after Jeddah and Madinah effective 25 May 2022.

Income between INR 5 lakhs-10 lakhs. Malaysia Airlines is the national carrier of Malaysia offering the best way to fly to from and around Malaysia. The cut would likely be temporary and a decision could be.

Income Tax in Malaysia. 2022 Tesla Model 3 in Malaysia priced from RM289k tax free PEKEMA aims to sell 500 Tesla EVs per year In Cars Local News Tesla Motors By Anthony Lim 6 December 2021 829 pm 51 comments. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions.

Tourist Arrivals in Malaysia averaged 156958287 from 1999 until 2021 reaching an all time high of 2806565 in December of 2013 and a record low of 5411 in May of 2020. KUALA LUMPUR May 10 Reuters - Malaysias commodities ministry has proposed cutting an export tax on palm oil by as much as half to help fill a global. Tax rebate for Self.

Calculate your net salary after tax in Malaysia with our easy to use and up-to-date 2022 income tax calculator. KLIA 10 May 2022. Malaysia the worlds second-largest palm oil producer could cut the tax to 4 percent-6 percent from the current 8 percent she said.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. The new service will provide passengers seamless connectivity via Hamad International Airport enabling optimal. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged.

10 of the income tax where the aggregate income is between Rs. Sales and Service Tax Malaysia Airlines Berhad Reg. Income up to INR 25 lakhs No Tax.

In 201920 the Direct tax collections reported by CBDT were approximately INR 1233 trillion. For employment income a monthly tax deduction MTD system is in operation whereby employers deduct monthly tax payments from the employment income of their employees. This page provides - Malaysia Tourist Arrivals - actual values historical data forecast chart statistics economic.

50 lakhs and Rs. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. This is in line with the 12th Malaysia Plan 12MP where the focus is on strengthening the digital services infrastructure and digitalising tax administration.

Online via MyEG website here. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat ReaderFor further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Through tax incentives the Government aims to attract foreign direct investments FDIs as investors from abroad need to be incentivised to relocate or set up their operations in Malaysia.

Ive renewed my car insurance with road tax renewal online with AIG. A few of these taxes include inheritance tax interest tax gift tax wealth tax etc. Feel free to direct message us on twitter and let us know.

India has abolished multiple taxes with passage of time and imposed new ones. Income higher than INR 10 lakhs. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Trying to get tariff data. Chartered Tax Institute of Malaysia 225750-T B-13-1 Block B Unit 1-5 13th Floor Megan Avenue II 12 Jalan Yap Kwan Seng. Tax rebate for self.

This tax rebate is why most Malaysia n fresh. Checkout MH Mobile App for latest deals.

7 Tips To File Malaysian Income Tax For Beginners

Business Income Tax Malaysia Deadlines For 2021

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

How To Calculate Income Tax In Excel

Cukai Pendapatan How To File Income Tax In Malaysia

Business Income Tax Malaysia Deadlines For 2021

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax In Excel

Income Tax Malaysia 2018 Mypf My

Gst In Malaysia Will It Return After Being Abolished In 2018

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

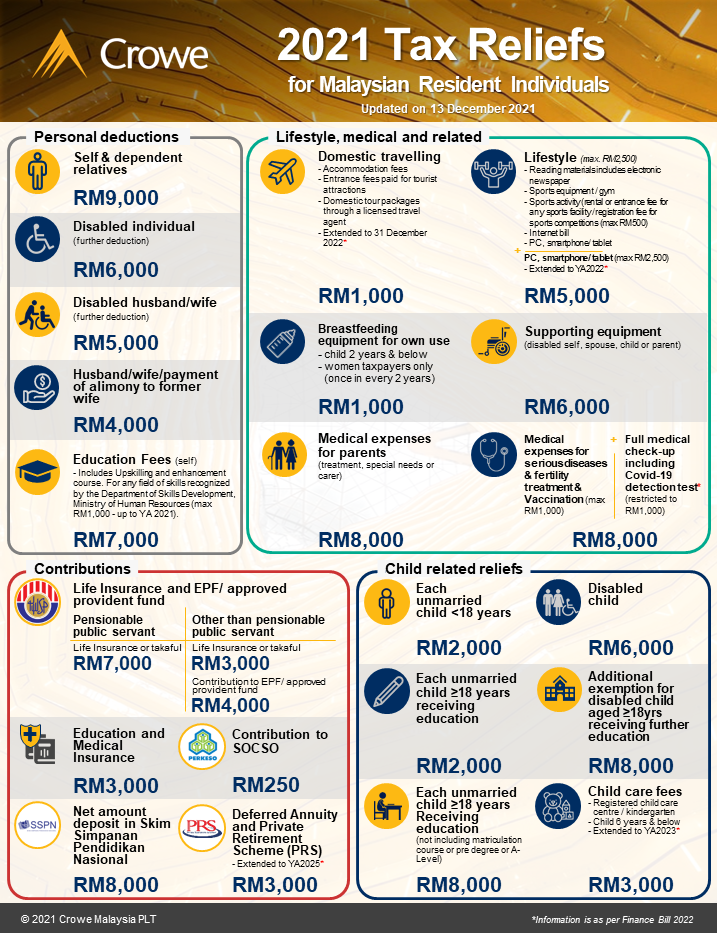

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Special Tax Deduction On Rental Reduction

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook